Five things we can learn from the bitcoin bubble

3 min read

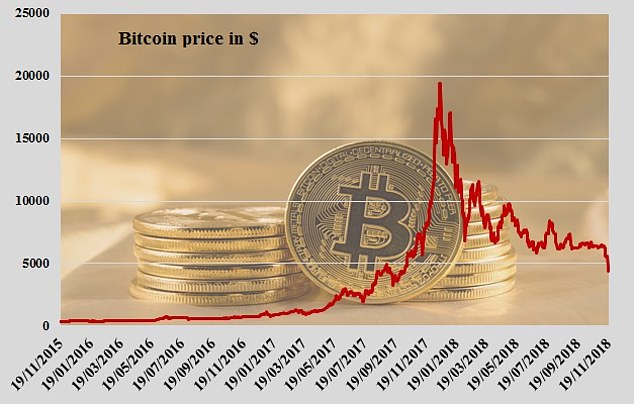

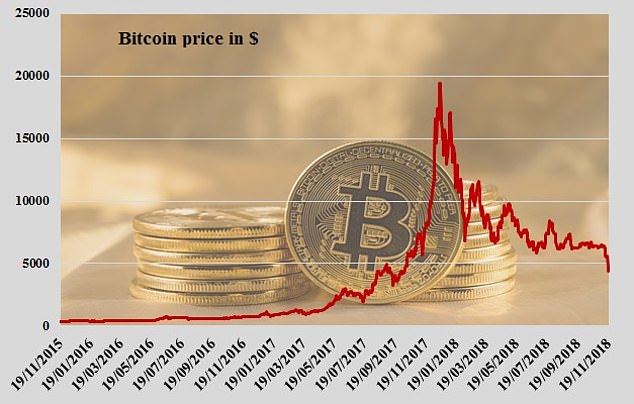

A year ago bitcoin began its astonishing run that mapped out one of the most striking bubbles of our times.

Today, the price of the cryptocurrency is $4,445 – some 46 per cent below where it stood this time last year.

That’s a mighty fall, but it is what happened between then and now that really matters.

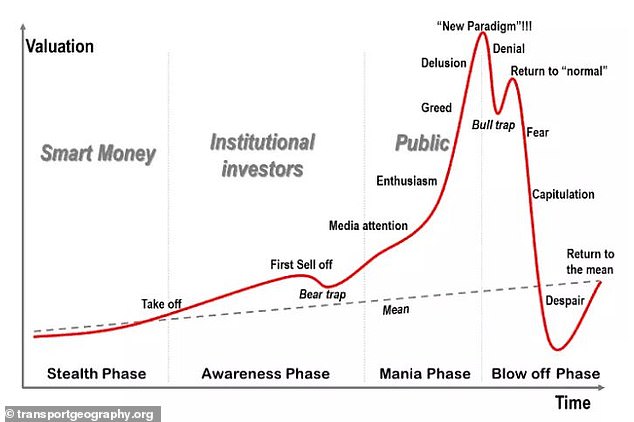

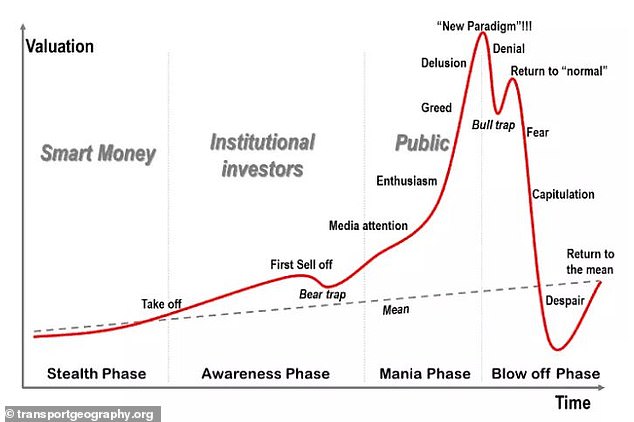

The classic bubble chart with the stages of a boom and bust maps out the hope, greed and fear of human behaviour

At which point in this column it is confession time: I bought some bitcoin at the start of February 2018. It had fallen substantially from the high and then stabilised and I bought at $7,800. Why?

I bought $1,200 (£870) worth of cryptocurrency, split evenly between bitcoin, ethereum and ripple, on the basis that I could see a scenario where in the long term they climbed back to their peak, or even higher.

It was a small chunk of my overall investment portfolio – a blue sky punt – and I thought that might be a good entry point.

The long term thinking part might still turn out to be correct, but clearly I was incorrect on the entry point bit of that theory. The bitcoin is down 44 per cent. the ethereum is down 86 per cent and the ripple is down 47 per cent. Overall, I am down 59 per cent.

Doh! as Homer Simpson would say.

So what have we learned from the bitcoin saga?

RELATED ARTICLES

Previous

1

2

Next

Bitcoin price nosedives 30% in a week to $4,450 leaving…

The next Bitcoin! Initiative Q is the ‘sign-up quick’ scheme…

Bitcoin: stick or twist? Cryptocurrency suffers annual loss…

MINOR INVESTOR: Where can you invest with protection?

Millennials ‘taking risks with their money’ like buying…

It’s a global gold rush! Worried central banks snap up £13…

Share this article

Share

46 shares

HOW THIS IS MONEY CAN HELP

How to choose the best (and cheapest) DIY investing Isa – and our pick of the platforms

1. It probably is a bubble

If it looks and feels like a bubble, then it probably is one. It was not different this time, bitcoin was a mania and eventually the bubble burst.

2. Don’t buy on the fear of missing out

Beware the danger of buying anything driven by the fear of missing out. It’s time to be cautious if you ever find yourself thinking: ‘Other people are making money, they could keep making money, I need to get in now to make money too’.

3. Watch out for value based on sentiment

Beware the even greater danger of doing the above when buying something that has nothing to back up its value. Assets such as shares, bonds, and even property, have a productive element underlying them.

Examples are a company’s ability to put money to profitable use, pay dividends, or interest on bonds, or a property’s potential to deliver a rental income. Bitcoin’s value was based purely on perception and sentiment.

4. Diversification can protect you

If you bought some bitcoin or cryptocurrencies as a small part of a larger portfolio of other investments, then its plummet from grace will have been annoying but not a major problem.

I would obviously rather that my £870 was not worth £380 now, but I can live with that, as a small element of my investments. On the other hand, had I put most of my money into this one thing, then the crypto collapse would be a big issue.

5. There will always be another bubble

Bitcoin was pretty special, you don’t see stories like that come along often – and who knows, it may rise again one day. But while it may not be on the same scale, something else will boom and bust.

The classic bubble chart works because it maps out human behaviour and how hope, greed and fear deliver market cycles.

Something else will come along and it will happen again.