The Santa Rally is real: UK investors do usually get a December run

2 min read

Just as young children eagerly anticipate the arrival of a jolly red and white suited man delivering gifts in December, investors also wait in hope for a Santa Rally.

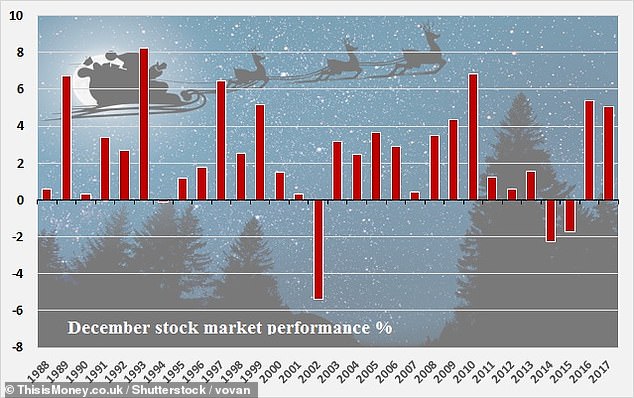

And the long-standing superstition that stock markets bounce in the run-up to Christmas has a fair amount of statistical backing, despite there being no clear explanation behind it.

Three reports from investment platforms, Interactive Investor, Fidelity and BestInvest supported the case by looking back over past Decembers.

Interactive Investor said that going back to 1984, December proved to be the best month for the UK stock market, while Bestinvest said the FTSE 100 has risen 79 per cent of the time in December since 1979 – and by a chunky 2.4 per cent on average.

Darius McDermott of Fund Calibre lists five funds set to prosper in the New Year

Scottish Mortgage Investment Trust

Ongoing charges: 0.37%

The trust has fallen recently due to tech sell-off as it has large holdings in some of the FAANG stocks and other more niche technology holdings as well (a gene sequencing company for example).

It could be an interesting time to invest though as long term themes are solid and growth strategies could still prevail in the shorter term.

BMO Global Smaller Companies

Ongoing charges: 0.85%

This trust invests in smaller companies and basically ignores the macro environment. Riskier assets like smaller companies get sold off more heavily when markets fall (as they have done), but could equally rally strongly if investors stop worrying.

Lazard Emerging Markets

Ongoing charges: 1.08%

Both the asset class and investing style (value) have been out of favour in recent years. If we get any positive surprises in terms of a less strong dollar or trade wars lessening, it could be a good contrarian fund to hold.

Schroder Global Recovery

Ongoing charges: 0.87%

This fund invests predominantly in larger developed market companies and has a value style too. We’ve started to see value out perform in the UK after a decade of underperformance vs growth and if this trend goes global this fund could do extremely well.

Jupiter UK Special Situations

Ongoing charges: 0.76%

This fund has managed to outperform the sector average despite the style headwind in recent years – defying the style-odds. Historically, when there has been a style rotation, it’s the early stages when the good money is made and his fund is well positioned to take advantage of any such change.